IT'S HAPPENING…

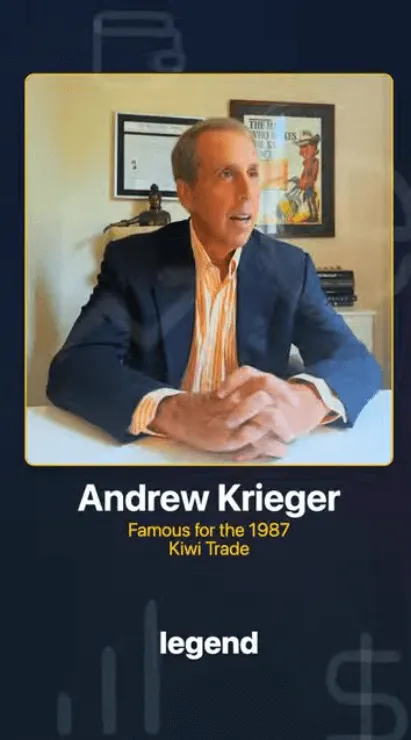

Get Inside the Mind of

Trader Hall of Famer Andy Krieger.

The Man Behind a Historic Billion-Dollar Trade...

Get updates on Andy’s latest teachings, live appearances, and resources.

NO SIGNAL-CHASING OR HYPE

GLOBAL MACRO PERSPECTIVE

40+ YEARS IN THE ARENAS THAT MATTER

Andrew “Andy” Krieger is a Trader Hall of Famer, best known for his legendary 1987 short of the New Zealand dollar, the “Kiwi,” a trade that reportedly generated hundreds of millions in profit and cemented his status as one of the most formidable currency traders in history.

Before Wall Street, he studied philosophy and South Asian studies at the University of Pennsylvania and went on to earn his MBA from the Wharton School.

He then built a career on elite trading floors, including Salomon Brothers, Bankers Trust (where he ran global currency options), and George Soros’s Quantum Fund, before launching his own funds and advisory work across more than seventy markets.

Over four decades, Andy has combined deep macro insight with disciplined risk management, advising central banks and financial institutions while continuing to teach serious traders how to think clearly, manage risk responsibly, and navigate markets through calm and crisis alike.

ANDY KRIEGER BY THE NUMBERS

4+

Decades in Global Markets

From the 1980s trading floors of Salomon Brothers and Bankers Trust to Soros’s Quantum Fund and beyond, Andy has spent more than forty years making real decisions with real capital.

70+

Markets Traded

Instant access to premium training worth over $4,500. Currencies, rates, equities, and commodities. Andy has applied his macro playbook across more than seventy markets through crashes, bubbles, and regime shifts.

#1

Historic Kiwi Trade

His famed short of the New Zealand dollar in 1987 generated hundreds of millions in profit and became one of the most talked-about currency trades in history.

HOW ANDY THINKS ABOUT MARKETS

Here’s the truth:

Longevity in markets has very little to do with finding a “magic strategy”…

and everything to do with how you think.

Andy’s approach has been forged across crashes, bubbles, and regime shifts.

He starts from the top down policy, flows, sentiment, valuation—then drills into the details to find where the crowd is mispriced and where risk/reward is truly asymmetric.

The “secret”? Build a deep understanding of the environment.

Wait patiently for dislocations.

Structure trades so your downside is limited and your upside is meaningful.

Review your decisions relentlessly and keep ego out of the way.

Some trades play out in days. Others take months or years.

That’s why process matters more than predictions. You will face drawdowns, uncertainty, and moments of doubt, everyone does.

The difference is whether you have a framework you trust when volatility hits.

Andy’s life’s work is about that framework:

helping serious students develop a way of seeing markets that can last a lifetime.

WHAT YOU’LL FIND IN ANDY’S WORLD

REAL MARKETS, REAL STORIES

Experience how major trades actually unfold: the build-up, the doubt, the risk, and the decision-making behind historic moments like his famed Kiwi trade.

SKILLS THAT FMACRO FRAMEWORKS THAT LAST

Discover how Andy evaluates countries, currencies, interest rates, and cross-asset flows and how those ideas can be applied across regimes and decades.

PRINCIPLES FOR RESPONSIBLE

RISK-TAKING

Learn why protecting the downside is as important as seeking opportunity, and how Andy thinks about position sizing, timing, and emotional discipline.

INSIGHT INTO CRISIS AND OPPORTUNITY

Understand what changes when markets snap, crashes, policy shocks, and bubbles\ and how a seasoned macro trader prepares for and navigates those periods.

A FOCUS ON CLARITY, NOT COMPLEXITY

Andy’s greatest strength isn’t just seeing patterns others miss, it’s explaining them simply, so serious learners can integrate them into their own thinking.

MACRO FRAMEWORKS THAT LAST

Discover how Andy evaluates countries, currencies, interest rates, and cross-asset flows, and how those ideas can be applied across regimes and decades.

WAYS TO ENGAGE

ONLINE LEARNING HUB

Watch Andy break down historic trades, current macro themes, and risk frameworks from anywhere in the world. Revisit the key sessions at your own pace so the lessons actually sink in.

GLOBAL COMMUNITY OF SERIOUS TRADERS

Connect with investors, traders, and students who follow Andy’s work. Share ideas, ask questions, and learn alongside people who care about risk, responsibility, and long-term success in markets.

MAJOR MARKETS ANDY HAS TRADED

GLOBAL CURRENCIES

From the New Zealand dollar and Australian dollar to the euro, yen, and pound, Andy has spent his career in FX. His Kiwi trade may be the most famous, but it grew out of thousands of hours watching how currencies react to policy, flows, and fear.

INTEREST RATES AND GOVERNMENT BONDS

Andy has traded interest rate futures and government bonds across the US, Europe, and Asia. He studies how central banks move, how yield curves shift, and where markets are mispricing growth and inflation.

EQUITY INDICES

Beyond single currencies, Andy has managed positions in major stock indices such as the S&P 500 and global benchmarks. He uses macro insight to understand when equity markets are priced for perfection and when fear has gone too far.

COMMODITIES AND PRECIOUS METALS

Gold, oil, and other key commodities have been part of Andy’s macro toolkit. He connects them to currency moves, real rates, and geopolitical risk so they are never traded in isolation.

EMERGING AND CROSS-MARKETS

Andy has operated in more than seventy markets worldwide. That includes emerging currencies, cross rates, and less followed contracts where inefficiencies can be greatest and careful risk management matters most

Who Thrives With Andy’s Frameworks

ASPIRING TRADERS

You’re serious about learning markets the right way and want to build a foundation grounded in real-world experience, not social-media noise.

PROFESSIONALS & EXECUTIVES

You manage risk, capital, or strategy and want a deeper macro lens to make better decisions in volatile environments.

ENTREPRENEURS & BUSINESS OWNERS

You’re responsible for growth and capital allocation and want to understand how global currencies, rates, and crises can impact your business.

STUDENTS OF MACRO & FINANCE

You’re intellectually curious, drawn to economics, policy, and markets, and want to learn directly from someone who has traded at the highest levels.

STAY CLOSE TO ANDY’S THINKING

You are not just learning from one trader’s story. You are stepping into a global circle of investors, traders, students, and thinkers who follow Andy’s work to better understand risk, opportunity, and responsibility in markets.

Whether you are just beginning or already managing meaningful capital, you will find perspective, challenge, and support from people who take markets - and risk - seriously.

You’re not just learning valuable skills—you’re joining an elite network of 50,000+ motivated individuals all working towards financial freedom.

Lock in your spot and start today.

FREQUENTLY ASKED QUESTIONS

Who is Andy Krieger?

Andy is a Trader Hall of Famer and veteran macro and currency trader best known for his 1987 short of the New Zealand dollar and his work at firms such as Salomon Brothers, Bankers Trust, and George Soros’s Quantum Fund.

Does Andy give investment advice or trade signa

No. Andy’s public work is educational. He shares how he thinks about markets, risk, and opportunity, but he does not provide personalized investment advice or specific trade recommendations.

Is Andy’s work only for professional traders?

Not at all. Many professionals follow his work, but Andy’s thinking also resonates with business owners, students, and anyone who wants a deeper understanding of how global markets really function.

How can I start learning from Andy?

Begin by joining his email list, exploring his writing and interviews, and watching for upcoming events or learning experiences announced on this site.

What is Andy’s core philosophy on risk?

He believes in respecting risk, protecting the downside, and only taking large positions when preparation, conviction, and structure all line up. Survival and longevity always come before short-term gains.

Terms & Conditions | Privacy Policy | Contact